Financial Planning is the financial management which an individual or a family unit performs to budget, save, and spend monetary resources over time, taking into account various financial risks and future life events. When planning finances, the individual would consider the suitability to his or her needs of a range of banking products (savings accounts, fixed deposit, credit cards and consumer loans) or investment (stock market, bonds, mutual funds) and insurance (life insurance, health insurance, motor insurance) products or participation and monitoring of individual- retirement plans, education plans, and income tax management.

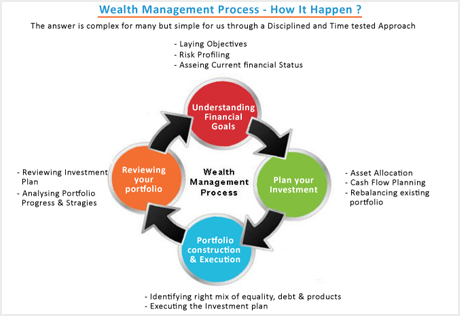

Monitoring and reviewing the progress of financial plan is very important. In this regard we provide following services:

Mutual funds have gained popularity among the investing public especially in the last two decades. Following are some of the primary benefits of investing in mutual funds:

A. Tax Benefits on Investment in Mutual Fund-